Impresa globale

Studi comparativi cross-country

18 Luglio 2013 • di Cristiana Barbatelli , Valeria Crivellari

Importing products from Hong Kong to mainland trough CEPA

![]() effettua il login per scaricare il pdf

effettua il login per scaricare il pdf

Commenta (0 presenti)

PREAMBLE:

The Mainland and Hong Kong Closer Economic Partnership Arrangement (CEPA) is the first free trade agreement ever concluded between the Mainland of China and Hong Kong.

In order to strengthen trade and investment cooperation between the Mainland and the Hong Kong Special Administrative Region, CEPA promotes joint development of the two sides, through the implementation of the following measures:

- progressively reducing or eliminating tariff and non-tariff barriers on substantially all the trade in goods between the two sides;

- progressively achieving liberalization of trade in services through reduction or elimination of substantially all discriminatory measures;

- promoting trade and investment facilitation.

CEPA is a win-win agreement, bringing new business opportunities to the Mainland, Hong Kong and all foreign investors. For Hong Kong, CEPA provides a window of opportunity for Hong Kong businesses to gain greater access to the Mainland market. CEPA also benefits the Mainland as Hong Kong serves as a perfect "springboard" for Mainland enterprises to reach out to the global market and accelerating the Mainland's full integration with the world economy.

The main text of CEPA was signed on 29 June 2003.

CEPA Main Text and Six Annexes (signed on 29 June 2003 and 29 September 2003 respectively)

link: http://www.tid.gov.hk/english/cepa/legaltext/fulltext.html

DESCRIPTION OF THE OPERATION:

The possibility and feasibility of an operation such as importing products of different nature from Hong Kong to Mainland through CEPA has to be analyzed by two different points of view: as exporter and as importer.

- THE EXPORTER:

STEP 1 - CONDITION FOR ISSUING

(i) Rules of origin

Goods exported from Hong Kong to the Mainland must fulfill the CEPA origin rules in order to claim zero tariff under CEPA. You have to search and find the customs code serial number of the products which need to be imported.

link: http://www.tid.gov.hk/english/cepa/tradegoods/files/mainland_2013.pdf

(ii) Factory registration and manufacturer’s authorized signatory

To claim the tariff preference, each consignment of goods exported to the Mainland must be accompanied by a Certificate of Hong Kong Origin - CEPA ("CO(CEPA)") issued by the Trade and Industry Department or one of the five Government Approved Certification Organizations. But before applying for CO(CEPA), the Hong Kong manufacturer concerned is required to apply for Factory Registration (FR) with the Trade and Industry Department to demonstrate that its factory possesses sufficient capacity to produce the goods for export.

FR registrants are legally bound to observe all conditions of registration and they have to ensure all registration particulars (e.g. address, ownership, products, line of production, machinery, etc) are accurate and up-to-date. FR registrants are also required to register with TID the up-to-date Hong Kong HS codes for the goods they produce. If FR registrants fail to update their registration particulars or their CO(CEPA) applications cover goods of Hong Kong HS codes that are not registered with TID, their CO(CEPA) applications will be deferred or rejected. It is therefore in the interest of manufacturers/subcontractors to provide TID with up-to-date information by returning completed form "Application for Amendment of Registration Particulars under Factory Registration (FR)" as and when necessary.

The form can be downloaded from TID's webpage:

http://www.tid.gov.hk/english/aboutus/form/publicform/others/allforms.html#Factory

To protect the interest of the trade and as a measure to uphold the integrity of Hong Kong's origin certification system, any CO(CEPA) application which is not signed by the authorized signatory of the FR registrant will be deferred or rejected. Traders should therefore make sure that their CO(CEPA) applications are lodged by their authorized signatories.

(iii) Labelling Requirements

Origin marking or labelling is not mandatory for goods exported to the Mainland for CEPA zero

tariff preference. However, if a trader would like to apply origin markings on goods for export under CEPA, they should mark their goods as "Made in Hong Kong" provided that the CEPA ROO is met. For fish and aquaculture products, the marking or labelling of "Made in Hong Kong" can be applied only if the fish and aquaculture products are (a) born and bred in Hong Kong, or (b) obtained in Hong Kong waters.

(iv) Additional Requirements for Traders who wish to include Product Development Cost in the

CO(CEPA) Applications

Traders who wish to include product development cost in their CO(CEPA) applications for products with "value-added content" as ROO must fulfill additional conditions. Details are set out in Certificate of Origin Circular No. 24/2003 on "Additional Conditions for Including Product

Development Cost in CO(CEPA) Applications" issued on 14 November 2003

link: http://www.tid.gov.hk/english/aboutus/tradecircular/coc/2003/coc242003.html

(v) If the Value of Raw Materials and Component Parts of Mainland Origin is Included in

Calculating the "Value-Added Content"

Traders who wish to include the value of raw materials and component parts originating from the Mainland when calculating the "value-added content", in addition to complying with the original FR requirements under CEPA, they have to submit to TID the additional Declaration and Undertaking Form (Form FRVAC 1). Manufacturers should return the abovementioned Declaration and Undertaking Form to TID's FR&OC Branch at least 7 working days before submitting CO(CEPA) applications. Upon acceptance of the relevant additional Declaration and Undertaking Form, TID will issue a "reference number" to the manufacturer. Details are set out in Certificate of Origin Circular No. 2/2012 on "Requirements for including the value of raw materials and component parts of Mainland origin in the "value-added content" origin rule" issued on 19 March 2012.

link: http://www.tid.gov.hk/english/aboutus/tradecircular/all_in_one/2012/as012012.html

STEP 2 - APPLICATIONS FOR CO(CEPA)

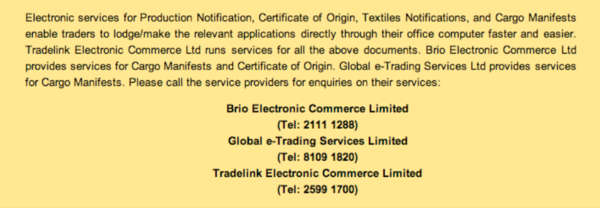

All CO(CEPA) applications (including fresh submissions, re-submissions and amendment requests) have to be lodged through electronic trade document submission services. Traders may register with the relevant Certificate of Origin ("CO") Service Providers appointed by the

Government in order to use the electronic trade document submission services. Traders who are not registered with the Service Providers can also make use of the designated Service Centres provided by the Service Providers for lodging CO(CEPA) applications.

(i) In lodging a CO(CEPA) application, traders should provide all required information accurately. Applicants have to comply with the following requirements.

a. The exporter, manufacturer, and subcontractor (if applicable) have to make the following declaration in the CO(CEPA) application:

CEP - I declare that the goods described in this application comply with the origin requirements specified for those goods in the Closer Economic Partnership Arrangement (CEPA).

b. Each CO(CEPA) can only be used to cover one batch of goods entering into the Mainland at the same time.

c. Traders are required to provide the Mainland 8-digit tariff codes corresponding to the goods concerned according to the applicable "Customs Import and Export Tariff of the People's Republic of China". The Mainland tariff codes will be printed on the CO(CEPA).

d. Each CO(CEPA) can cover a maximum of 5 product items with their Mainland 8-digit tariff codes, and all of them must be goods eligible for zero tariff preference under CEPA.

e. For each product item that corresponds to a Mainland 8-digit tariff code, a separate entry has to be provided for each of the following:

- number and type of packages;

- quantity and quantity unit; and

- FOB value in Hong Kong dollars

f. Rules of Origin: Manufacturers should clearly state the principal manufacturing processes performed in the field "Principal Process(es) Done by Manufacturer and Outworker in HK". Where "Change in Tariff Heading" and/or "Value-added content requirement" is the origin criterion of the concerned products, it should be so stated.

g. Some fields will require the input of data codes to allow certain information to be printed in Chinese on the CO(CEPA) :

• Mode of Transport - please refer to TID's webpage <http://www.tid.gov.hk/service/co/jsp/COEnq_CepaAreaMain_e.jsp> for the input codes. The corresponding mode of transport will be printed on the CO(CEPA) in Chinese.

• Port of Loading - the port of loading must be Hong Kong. "Hong Kong" as the port of loading will be printed on the CO(CEPA) in Chinese.

• Port of Discharge - please refer to the web portal of the Mainland Customs at < http://www.customs.gov.cn> or TID's webpage < http://www.tid.gov.hk/service/co/jsp/COEnq_CepaAreaMain_e.jsp> for the Mainland customs port codes. The corresponding port of discharge will be printed on the CO(CEPA) in Chinese.

• Quantity Unit - please refer to TID's webpage <http://www.tid.gov.hk/service/co/jsp/COEnq_CepaAreaMain_e.jsp> for the input codes. The corresponding quantity unit will be printed on the CO(CEPA) in Chinese. The above input codes may be subject to change. Traders should check from the webpages of TID or the Mainland Customs from time to time for the latest set of input codes.

h. The port of discharge declared on the CO(CEPA) applications should be the customs port to which the importer will submit the claim for zero tariff preference.

i. The consignee's information will be printed on the CO(CEPA). Exporters cannot choose to hide such information on the CO(CEPA).

j. Under normal circumstances, the departure date should be at least 2 clear working days after the date of lodging of the application. Request for retrospective issuance of CO(CEPA) will not be entertained.

k. Materials imported into the Mainland for processing trade are not covered by the zero tariff preference under CEPA and hence should not be included in CO(CEPA) application.

(ii) Traders are advised to read the "Note for Traders Lodging CO(CEPA) Applications" carefully before applying for CO(CEPA). The Note can be downloaded from TID's webpage http://www.tid.gov.hk/english/aboutus/publications/registcert/cocepa_note.html or obtained from the FR&OC Branch of TID.

STEP 3 - PROCESSING, APPROVAL AND VALIDITY OF CO(CEPA) APPLICATION

(i) Target turnaround time for processing CO(CEPA) application is 1.5 clear working days (excluding day of receipt)3 . Traders are reminded that TID will no longer count Saturday as a working day since the implementation of "5-Day Week" from 1 July 2006. Notwithstanding this, GACOs will continue to maintain services on Saturday mornings and they will count Saturdays as working days.

(ii) Approved CO(CEPA) will be printed on green A4-sized paper bearing watermark of the issuing organization [CO(CEPA) specimen is at the Annex (pdf format)]. Upon approval, information on the CO(CEPA) will be transmitted to the Mainland by electronic means, in order to facilitate checking and verification by the Mainland Customs.

(iii) CO(CEPA) is valid for 120 days from the date of issue. An expired CO(CEPA) cannot be

accepted for claiming zero tariff preference.

- THE IMPORTER

(i) The purpose of a CO(CEPA) is to support the Mainland importer's claim for CEPA zero tariff

preference. Mainland importers are also required to provide other documentation as required by the Mainland Customs. Hong Kong exporters should make sure that the information declared on CO(CEPA) corresponds to that in the import declaration and other relevant documentation.

(ii) The Mainland Customs at the port of clearance will verify the information on CO(CEPA) against the information transmitted by TID through electronic means. If the information is verified to be in order, the imported goods will be granted zero tariff treatment. In the event that the information cannot be verified through electronic means, the Customs at the port of clearance may, at the request of the importer, act in accordance with the stipulated import procedures and release the goods. However, a deposit of an amount equal to the tariff charged at the applicable non-CEPA import tariff rate will be collected for the goods concerned pending the result of subsequent verification.

(iii) Moreover, if the Mainland Customs at the port of clearance has doubts about the authenticity of the content of a CO(CEPA), it may collect a deposit of an amount equal to the tariff charged at the applicable non-CEPA import tariff rate before releasing the goods. The Mainland Customs may then request the Hong Kong Customs and Excise Department (C&ED) for verification of the status of the CO(CEPA) concerned. The Mainland Customs at the port of clearance will, in accordance with the verification results, proceed with the procedure to either return the deposit or convert the deposit to import tariff.

(iv) In the event that traders encounter problems in customs clearance of goods covered by a

CO(CEPA), they may seek assistance from the FR&OC Branch of TID (tel. no. 3403 6432 or email

addresss cepaco@tid.gov.hk). However, TID will not accept any liability in cases where the

Mainland authorities do not accept the claim for CEPA zero tariff preference.

STEP 1 - 3C INSPECTION CERTIFICATION (CCC)

CCC is similar to other certifications for the standardization of product quality, such as the European CE system, but there are important differences. The CCC certificate was introduced in 2002 and applies to imported goods as well as to Chinese products. The products requiring certification may only be imported to China, sold in China and used in business activities in China, after a CCC certification was passed.

Not complying with the CCC-regulations will lead to import goods being detained at the border or returned to the sender. On improper use of CCC license or printing the CCC-mark on products without certification, fines and court procedures are imposed. Even if your products actually do not need CCC, customs problems still might arise if customs officers demand a CCC certificate.

Clearance Certificates (http://www.china-certification.com/en/ccc-clearance-certificate) for these goods significantly reduce the risk of customs problems.

The CCC certification replaced the certifications of the “China Import and Export Commodity Inspection Bureau (CCIB)” and the “China Commission for Conformity Certification of Electrical Equipment (CCEE)” thereby simplifying foreign trade with China significantly. CCC created a“level playing field” for all market participants. Special certificates, for example for medical products (SFDA) and telecommunication equipment, however, remain in place.

The two most important elements of CCC certification are product testing (products that are to be certified in China are sent to test laboratories in China) and factory audits (inspections of the factories that manufacture the products that are to be certified by Chinese auditors). The certification is valid for several years but must be maintained by annual follow-up audits.

The steps to the entire CCC certification also include comprehensive document traffic and various payment transactions. With consulting support, the entire process can be completed within about 4-5 months. Without consulting support, the process will typically take between 6-18 months.

These are the most important Chinese certification authorities:

- The Chinese central authority CNCA (Certification and Accreditation Administration) administers the China marks and sets the guidelines.

- The CQC (China Quality Certification Centre) is responsible for conducting the certification

- The CCAP (China Certification Centre for Automotive Products) handles certification of automotive parts.

http://www.china-certification.com/en/what-is-ccc

http://www.china-certification.com/en/ccc-booklet

STEP 2 - CERTIFICATE OF ORIGIN (CEPA - CERTIFICATE)

(see “the importer ”)

STEP 3 - MARINE BILL OF LADING

A bill of lading is a document issued by a carrier to a shipper, signed by the captain, agent, or owner of a vessel, and stating the conditions in which the goods were delivered to (and received by) the ship; and an engagement to deliver goods at the prescribed port of destination to the lawful holder of the bill of lading. A bill of lading is, therefore, both a receipt for merchandise and a contract to deliver it as freight. It is a document of title to the goods, enabling the shipper or owner of the goods to endorse title to other parties, sell goods in transit, and Present to banks with other documents in seeking payment under documentary credits. Abbreviated generally as B/L, it is the most important document for sea transport. There are a number of different types of bills of lading.

STEP 4 – INVOICE

STEP 5 - PACKING LIST

STEP 6 - AUTHORIZATION LETTER FOR CUSTOMS DECLARATION

Any Customs clearing agent entrusted by the exporter or the importer of import or export goods to complete Customs formalities in the principal's name shall produce to the Customs a letter of authorization and comply with all the provisions governing the principal provided for in this Law.

Where a Customs clearing agent is entrusted by the importer or exporter of import or export goods to complete Customs formalities in its own name, it shall bear the same legal liability as the importer or exporter.

A principal shall, in the case of entrusting a Customs clearing agent to complete the Customs formalities, provide to the enterprise true information regarding the entrusted declaration.

Enterprises so entrusted shall verify where appropriate the authenticity of the information provided by the principal.

http://english.customs.gov.cn/publish/portal191/tab47812/info391083.htm

STEP 7 - INSPECTION OF ATTORNEY

Customs may require the importer of import goods and the exporter of export goods to provide with the information indispensable for determination of classification. Customs may, whenever necessary, carry out laboratory analysis and inspection and such results confirmed by Customs shall be taken as the basis of classification.

http://english.customs.gov.cn/publish/portal191/tab47812/info391083.htm

STEP 8 - CONTRACT

The Parties have to enter a regular sales contract where terms an conditions of the supply are

stated as well as payment conditions Important Note It is the responsibility of traders to complete the application for CO(CEPA) fully and truthfully, and provide the supporting documents as required under the issuing conditions for CO(CEPA). Failure to provide accurate and complete information may affect the consideration and processing of the application, and may result in the application being deferred or rejected.

STEP 9. PAYMENTS

Payment in RMB and settlement in Hongkong .

Payments can be settled in RMB between companies.

SAFE has defined three eligibility categories, A, B and C – and only companies in Category A are

eligible to transact cross-border trade under the simplified scheme. By default, companies with a track record of compliance with foreign exchange administration processes will fall under Category A. However, a company’s categorization can be changed according to its compliance or noncompliance with foreign currency administration requirements.

In Guangdong province ( with the exclusion of Shenzhen City registered Companies) the

requirements are:

Contract for goods (only) advance transactions

Customs information required if the transaction goes over quota

Under the terms of the scheme, validation of authorized importers and exporters is performed at an entity level rather than transaction level, depending on a company’s total importand export volume.

Banks are able to handle foreign exchange payments directly on behalf of their clients on the basis of one of three documents proving the legitimacy of a transaction (e.g. invoice, contract, customs documentation) as opposed to all three that were required in the past. In addition, collections in foreign currency resulting from export transactions are no longer subject to online inspections.

Banks also need to go through a less complex process for inspecting foreign currency payments and receipts, accelerating value dating of payments and collections, as well as allowing more accurate forecasting.

Otherwise payments will be dealt with in foreign currency according to existing SAFE standard

provisions for international settlement.

Commenta (0 presenti)